Examine This Report on Automobile Insurance In Toccoa Ga

Wiki Article

Little Known Questions About Medicare Medicaid In Toccoa Ga.

Table of ContentsThe Final Expense In Toccoa Ga DiariesNot known Details About Affordable Care Act Aca In Toccoa Ga The Basic Principles Of Life Insurance In Toccoa Ga The Basic Principles Of Commercial Insurance In Toccoa Ga

An economic advisor can additionally assist you choose how ideal to attain objectives like saving for your child's university education and learning or settling your debt. Although financial advisors are not as fluent in tax obligation legislation as an accounting professional could be, they can offer some support in the tax obligation preparation procedure.Some financial advisors use estate planning services to their customers. They may be trained in estate preparation, or they may want to collaborate with your estate attorney to respond to questions regarding life insurance policy, trusts and what need to be performed with your financial investments after you pass away. It's essential for economic advisors to remain up to day with the market, economic conditions and advising best methods.

To offer investment products, consultants need to pass the relevant Financial Industry Regulatory Authority-administered tests such as the SIE or Collection 6 tests to get their certification. Advisors that want to market annuities or various other insurance coverage items have to have a state insurance policy certificate in the state in which they intend to sell them.

The Ultimate Guide To Commercial Insurance In Toccoa Ga

You work with a consultant that bills you 0. Because of the common cost structure, several advisors will not function with customers who have under $1 million in assets to be taken care of.Investors with smaller sized portfolios could seek a monetary consultant that bills a per hour cost rather of a percent of AUM. Per hour charges for consultants commonly run between $200 and $400 an hour. The more facility your economic situation is, the more time your expert will certainly have to devote to handling your properties, making it extra pricey.

Advisors are competent experts that can help you establish a strategy for monetary success and implement it. You might also consider connecting to an advisor if your individual economic situations have actually just recently become much more complex. This could indicate acquiring a home, getting married, having youngsters or getting a large inheritance.

Home Owners Insurance In Toccoa Ga Fundamentals Explained

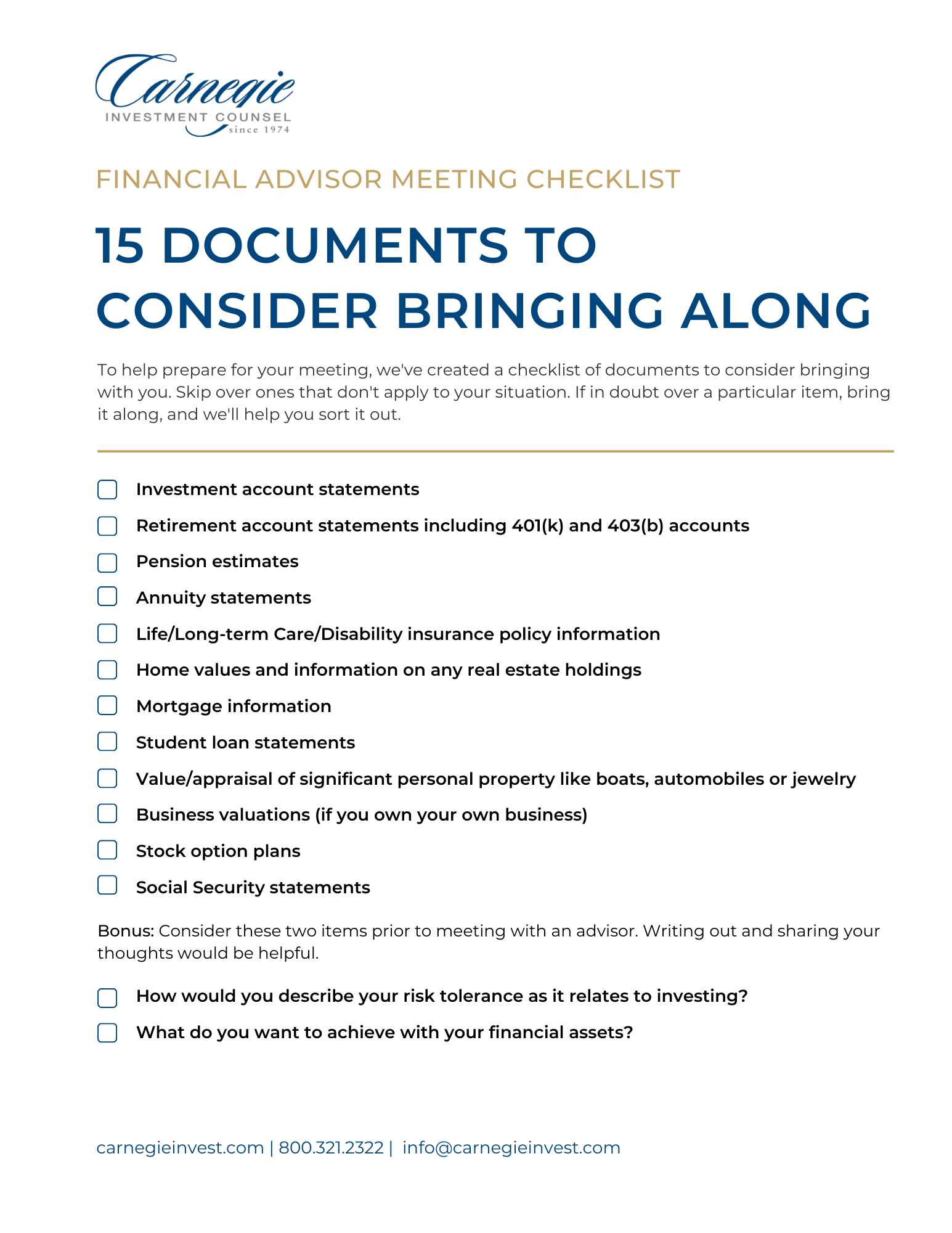

Before you meet with the advisor for a first examination, consider what solutions are most vital to you. You'll desire to seek out an advisor that has experience with the solutions you want.The length of time have you been advising? What business were you in before you got right into monetary suggesting? Who makes up your common customer base? Can you supply me with names of a few of your customers so I can discuss your solutions with them? Will I be working with you directly or with an associate consultant? You might likewise intend to consider some sample economic plans from the expert.

If all the samples you're given are the exact same or comparable, it may be an indication that this consultant does not properly personalize their advice for every customer. There are three main kinds of financial advising specialists: Qualified Monetary Coordinator experts, Chartered Financial Analysts and Personal Financial Specialists - https://www.slideshare.net/jimthomas30577. The Licensed Financial Planner expert (CFP specialist) accreditation shows that an expert has actually met a specialist and honest standard set by the CFP Board

Getting My Life Insurance In Toccoa Ga To Work

When picking a financial expert, think about a person with a specialist credential like a CFP or CFA - https://peatix.com/user/19389913/view. You might also think about a consultant who has experience in the services that are most essential to youThese experts are generally filled with disputes of rate of interest they're a lot more salespeople than experts. That's why it's crucial that you have a consultant who works only in your ideal passion. If you're seeking an expert who can truly offer actual value to you, it's important to look into a number of possible choices, not simply select the first name that advertises to you.

Presently, many consultants have to act in your "best passion," however what that requires can be nearly void, except in the most egregious instances. You'll need to locate an actual fiduciary.

0, which was passed at the end of 2022. "They need to prove it to you by showing they have taken major recurring training in retired life tax and estate planning," he says. "In my over 40 years of method, I have seen pricey irreparable tax obligation mistakes as a result of ignorance of the tax obligation policies, and it is unfortunately still a large problem." "You ought to not spend with any kind of consultant who does not invest in their education.

Report this wiki page